Oil Prices Continue To Move Higher As Demand Continues To Climb

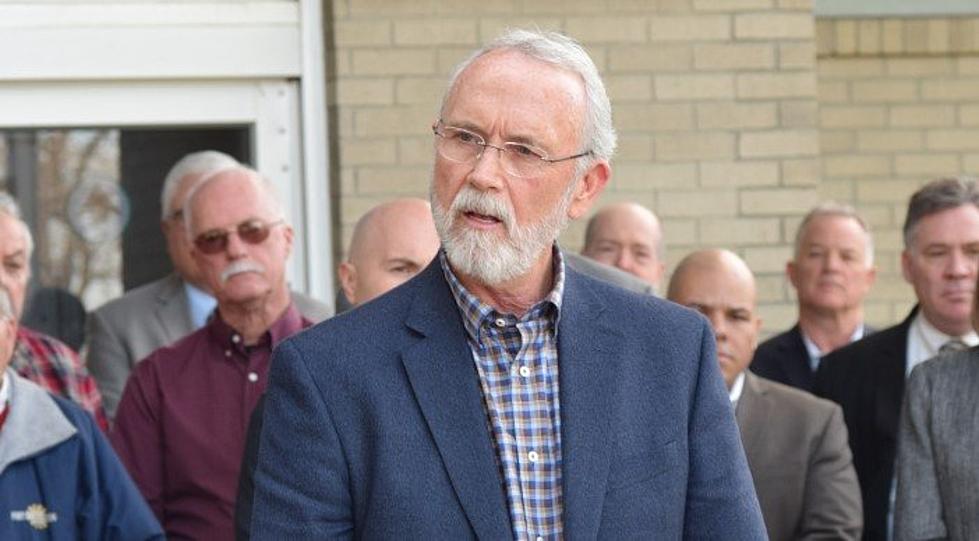

Oil prices continue the slow climb higher that consumers have seen for several months at this point. Patrick DeHaan with GasBuddy says a barrel of West Texas Crude was up to around $71 in Monday’s trade. And he noted there are two key issues pushing those oil prices higher.

First, DeHaan noted, demand for oil and fuels has increased to some of the highest levels since the pandemic broke out. Second is a lack of supply to meet that demand.

So, why can’t oil producing countries just increase supply? DeHaan says it’s not that easy. Adding that OPEC wants to keep this balance where they earn more for each barrel of oil purchased.

“Here in the U.S., where oil production is not scrutinized, or not controlled, U.S. oil producers likely feeling the pain still of a 2020 in which some producers went bankrupt, thousands of people were laid off. It’s difficult in this environment to bring back the labor and skills necessary as quickly.”

DeHaan added a new part of the equation is fewer and fewer investors interested in being associated with oil, gasoline or any other fossil fuels.

“I believe now both New York and California have nearly divested completely of fossil fuels companies. They’re taking a social standing to fight back against climate change, so we’re in a position where we’re taking about billions, potentially billions of dollars of positions being exited, and with fewer shareholders and fewer individuals buying into fossil fuels companies, they may lack the resources they previously had.”

When it comes to the months ahead, DeHaan says 2021 is shaping up to be very similar to 2014.

If you have a story idea for the PNW Ag Network, call (509) 547-1618, or e-mail gvaagen@cherrycreekmedia.com

More From PNW Ag Network